Articles

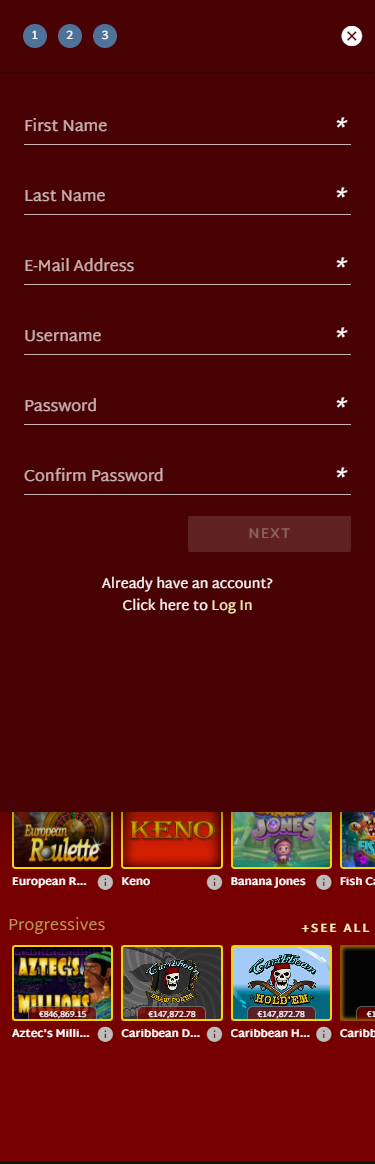

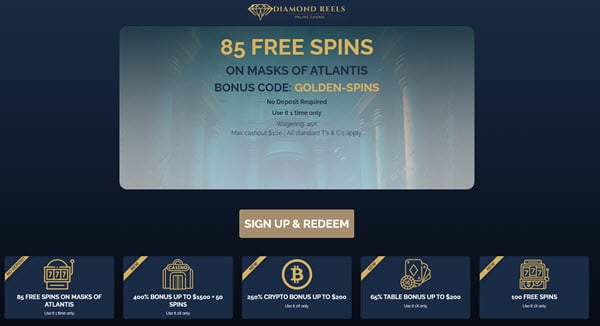

- Will i However Get Gambling establishment Bonuses Playing with Pay From the Cellular telephone Expenses For Dumps?

- Payforit Shell out From the Mobile Casinos

- Fortune Gambling establishment Has A captivating Invited Incentive

- Allege Your pay Because of the Mobile phone Incentive

- $5 Lowest Put Having Skrill

Uk shell out because of the cell phone costs gambling establishment web sites render highest playing profiles with various form of gambling entertainment. By going for a great shell out by the cellular telephone online casino from your list, you can enjoy each other online slots games and antique online casino games including since the roulette, blackjack, baccarat, casino poker although some. (more…)

What Is a Machine Learning Algorithm?

There are dozens of different algorithms to choose from, but there’s no best choice or one that suits every situation. But there are some questions you can ask that can help narrow down your choices. In this case, the unknown data consists of apples and pears which look similar to each other.

ANNs, though much different from human brains, were inspired by the way humans biologically process information. The learning a computer does is considered “deep” because the networks use layering to learn from, and interpret, raw information. Machine learning is a subfield of artificial intelligence in which systems have the ability to “learn” through data, statistics and trial and error in order to optimize processes and innovate at quicker rates. Machine learning gives computers the ability to develop human-like learning capabilities, which allows them to solve some of the world’s toughest problems, ranging from cancer research to climate change. However, sluggish workflows might prevent businesses from maximizing ML’s possibilities. It needs to be part of a complete platform so that businesses can simplify their operations and use machine learning models at scale.

A machine learning model can perform such tasks by having it ‘trained’ with a large dataset. During training, the machine learning algorithm is optimized to find certain patterns or outputs from the dataset, depending on the task. The output of this process – often a computer program with specific rules and data structures – is called a machine learning model. Machine learning is a branch of artificial intelligence that empowers computers to learn from data, make predictions, and automate tasks without explicit programming.

In data mining, a decision tree describes data, but the resulting classification tree can be an input for decision-making. Machine learning supports a variety of use cases beyond retail, financial services, and ecommerce. It also has tremendous potential for science, healthcare, construction, and energy applications. For example, image classification employs machine learning algorithms to assign a label from a fixed set of categories to any input image. It enables organizations to model 3D construction plans based on 2D designs, facilitate photo tagging in social media, inform medical diagnoses, and more. Human resources has been slower to come to the table with machine learning and artificial intelligence than other fields—marketing, communications, even health care.

The datasets used in machine-learning applications often have missing values, misspellings, inconsistent use of abbreviations, and other problems that make them unsuitable for training algorithms. Furthermore, the amount of data available for a particular application is often limited by scope and cost. However, researchers can overcome these challenges through diligent preprocessing and cleaning—before model training. Having access to a large enough data set has in some cases also been a primary problem. Machine learning has made disease detection and prediction much more accurate and swift. Machine learning is employed by radiology and pathology departments all over the world to analyze CT and X-RAY scans and find disease.

- AI/ML technologies have the potential to transform health care by deriving new and important insights from the vast amount of data generated during the delivery of health care every day.

- It is constantly growing, and with that, the applications are growing as well.

- Given symptoms, the network can be used to compute the probabilities of the presence of various diseases.

- Further, as machine learning takes center stage in some day-to-day activities such as driving, people are constantly looking for ways to limit the amount of “freedom” given to machines.

- In practical applications, it is often advisable to compute the quality metrics for specific segments.

Altogether, it’s essential to approach machine learning with an awareness of the ethical considerations involved. By doing so, we can ensure that machine learning is used responsibly and ethically, which benefits everyone. A computer program is said to learn from experience E concerning some class of tasks T and performance measure P, if its performance at tasks T, as measured by P, improves with experience E. Many people are concerned that machine-learning may do such a good job doing what humans are supposed to that machines will ultimately supplant humans in several job sectors. In some ways, this has already happened although the effect has been relatively limited. When a machine-learning model is provided with a huge amount of data, it can learn incorrectly due to inaccuracies in the data.

Data compression

The machine learning model most suited for a specific situation depends on the desired outcome. For example, to predict the number of vehicle purchases in a city from historical data, a supervised learning technique such as linear regression might be most useful. On the other hand, to identify if a potential customer in that city would purchase a vehicle, given their income and commuting history, a decision tree might work best. In unsupervised machine learning, the algorithm is provided an input dataset, but not rewarded or optimized to specific outputs, and instead trained to group objects by common characteristics.

NASA, a renowned space and earth research institution, uses machine learning in space exploration. It partners with IBM and Google and brings together Silicon Valley investors, scientists, doctorate students, and subject matter experts to https://chat.openai.com/ help NASA explore. Machine learning improves every industry in today’s fast-paced digital world. The swiftness and scale at which ML can solve issues are unmatched by the human mind, and this has made this field extremely beneficial.

Many of these functionalities are part of InvGate’s AI engine, Support Assist. Suppose you are looking to start harnessing the power of AI to boost your help desk capabilities. In that case, we encourage you to try it as it seamlessly integrates into your IT infrastructure, improving first response times and data accuracy for better routing and reporting.

According to Statista, the Machine Learning market is expected to grow from about $140 billion to almost $2 trillion by 2030. Machine learning is already embedded in many technologies that we use today—including self-driving cars and smart homes. It will continue making our lives and businesses easier and more efficient as innovations leveraging ML power surge forth in the near future. Because these debates happen not only in people’s kitchens but also on legislative ml definition floors and within courtrooms, it is unlikely that machines will be given free rein even when it comes to certain autonomous vehicles. Technological singularity refers to the concept that machines may eventually learn to outperform humans in the vast majority of thinking-dependent tasks, including those involving scientific discovery and creative thinking. This is the premise behind cinematic inventions such as “Skynet” in the Terminator movies.

Machine learning is a useful cybersecurity tool — but it is not a silver bullet. We developed a patent-pending innovation, the TrendX Hybrid Model, to spot malicious threats from previously unknown files faster and more accurately. This machine learning model has two training phases — pre-training and training — that help improve detection rates and reduce false positives that result in alert fatigue.

Lawmakers advance bill to tighten White House grip on AI model exports – The Register

Lawmakers advance bill to tighten White House grip on AI model exports.

Posted: Thu, 23 May 2024 07:00:00 GMT [source]

You can calculate recall by dividing the number of true positives by the number of positive instances. The latter includes true positives (successfully identified cases) and false negative results (missed cases). This subcategory of AI uses algorithms to automatically learn insights and recognize patterns from data, applying that learning to make increasingly better decisions. Because it is able to perform tasks that are too complex for a person to directly implement, machine learning is required.

How Do You Decide Which Machine Learning Algorithm to Use?

The data is gathered and prepared to be used as training data, or the information the machine learning model will be trained on. For example, e-commerce, social media and news organizations use recommendation engines to suggest content based on a customer’s past behavior. In self-driving cars, ML algorithms and computer vision play a critical role in safe road navigation. Other common ML use cases include fraud detection, spam filtering, malware threat detection, predictive maintenance and business process automation. Generative adversarial networks are an essential machine learning breakthrough in recent times.

Below is a selection of best-practices and concepts of applying machine learning that we’ve collated from our interviews for out podcast series, and from select sources cited at the end of this article. We hope that some of these principles will clarify how ML is used, and how to avoid some of the common pitfalls that companies and researchers might be vulnerable to in starting off on an ML-related project. In terms of purpose, machine learning is not an end or a solution in and of itself.

What Is Artificial Intelligence (AI)? – Investopedia

What Is Artificial Intelligence (AI)?.

Posted: Tue, 09 Apr 2024 07:00:00 GMT [source]

Machine learning (ML) is a type of artificial intelligence (AI) that allows computers to learn without being explicitly programmed. This article explores the concept of machine learning, providing various definitions and discussing its applications. The article also dives into different classifications of machine learning tasks, giving you a comprehensive understanding of this powerful technology. Also, a machine-learning model does not have to sleep or take lunch breaks. Some manufacturers have capitalized on this to replace humans with machine learning algorithms. For example, when someone asks Siri a question, Siri uses speech recognition to decipher their query.

What are machine learning algorithms?

The model’s performance depends on how its hyperparameters are set; it is essential to find optimal values for these parameters by trial and error. Feature engineering is the art of selecting and transforming the most important features from your data to improve your model’s performance. Using techniques like correlation analysis and creating new features from existing ones, you can ensure that your model uses a wide range of categorical and continuous features. Always standardize or scale your features to be on the same playing field, which can help reduce variance and boost accuracy. Enroll in a professional certification program or read this informative guide to learn about various algorithms, including supervised, unsupervised, and reinforcement learning.

Alan Turing jumpstarts the debate around whether computers possess artificial intelligence in what is known today as the Turing Test. The test consists of three terminals — a computer-operated one and two human-operated ones. The goal is for the computer to trick a human interviewer into thinking it is also human by mimicking human responses to questions. The brief timeline below tracks the development of machine learning from its beginnings in the 1950s to its maturation during the twenty-first century. AI and machine learning can automate maintaining health records, following up with patients and authorizing insurance — tasks that make up 30 percent of healthcare costs.

Support-vector machines

Changes in business needs, technology capabilities and real-world data can introduce new demands and requirements. For example, the wake-up command of a smartphone such as ‘Hey Siri’ or ‘Hey Google’ falls under tinyML. With time, these chatbots are expected to provide even more personalized experiences, such as offering legal advice on various matters, making critical business decisions, delivering personalized medical treatment, etc. Several businesses have already employed AI-based solutions or self-service tools to streamline their operations.

If the goal is to minimize false positives (maximize precision), then a higher decision threshold may be more appropriate. On the other hand, if the goal is to minimize false negatives (maximize recall), then a lower decision threshold may be more appropriate. For example, in churn prediction, you can measure the cost of false negatives (i.e., failing to identify a customer who is likely to churn) as the lost revenue from this customer. You can measure the cost of false positives (i.e., incorrectly identifying a customer as likely to churn when they are not) as the cost of marketing incentives, such as discounts to retain the customer. Whenever you are interpreting precision, recall, and accuracy, it makes sense to evaluate the proportion of classes and remember how each metric behaves when dealing with imbalanced classes.

For instance, some models are more suited to dealing with texts, while they may better equip others to handle images. The model type selection is our next course of action once we are done with the data-centric steps. An understanding of how data works is imperative in today’s economic and political landscapes. And big data has become a goldmine for consumers, businesses, and even nation-states who want to monetize it, use it for power, or other gains.

ML technology looks for patients’ response markers by analyzing individual genes, which provides targeted therapies to patients. Moreover, the technology is helping medical practitioners in analyzing trends or flagging events that may help in improved patient diagnoses and treatment. ML algorithms even allow medical experts to predict the lifespan of a patient suffering from a fatal disease with increasing accuracy. Machine learning teaches machines to learn from data and improve incrementally without being explicitly programmed. Granite is IBM’s flagship series of LLM foundation models based on decoder-only transformer architecture. Granite language models are trained on trusted enterprise data spanning internet, academic, code, legal and finance.

A 2020 Deloitte survey found that 67% of companies are using machine learning, and 97% are using or planning to use it in the next year. Once the model is trained and tuned, it can be deployed in a production environment to make predictions on new data. This step requires integrating the model into an existing software system or creating a new system for the model. For instance, recommender systems use historical data to personalize suggestions.

However, it’s one of the simplest supervised learning algorithms and assumes that all features in the input data are independent of one another; one data point won’t affect another when making predictions. The data classification or predictions produced by the algorithm are called outputs. Developers and data experts who build ML models must select the right algorithms depending on what tasks they wish to achieve.

Customer lifetime value modeling is essential for ecommerce businesses but is also applicable across many other industries. In this model, organizations use machine learning algorithms to identify, understand, and retain their most valuable customers. These value models evaluate massive amounts of customer data to determine the biggest spenders, the most loyal advocates for a brand, or combinations of these types of qualities. Machine learning algorithms create a mathematical model that, without being explicitly programmed, aids in making predictions or decisions with the assistance of sample historical data, or training data.

Data preparation and cleaning, including removing duplicates, outliers, and missing values, and feature engineering ensure accuracy and unbiased results. One of the significant obstacles in machine learning is the issue of maintaining data privacy and security. As the significance of data privacy and security continues to increase, handling and securing the data used to train machine learning models is crucial.

Scientists focus less on knowledge and more on data, building computers that can glean insights from larger data sets. There are two main categories in unsupervised learning; they are clustering – where the task is to find out the different groups in the data. And the next is Density Estimation – which tries to consolidate the distribution of data. Visualization and Projection may also be considered as unsupervised as they try to provide more insight into the data. Visualization involves creating plots and graphs on the data and Projection is involved with the dimensionality reduction of the data. In practical applications, it is often advisable to compute the quality metrics for specific segments.

For example, when you search for ‘sports shoes to buy’ on Google, the next time you visit Google, you will see ads related to your last search. Thus, search engines are getting more personalized as they can deliver specific results based on your data. Looking at the increased adoption of machine learning, 2022 is expected to witness a similar trajectory. Machine learning is playing a pivotal role in expanding the scope of the travel industry.

Top 20 Highly Effective Use Cases of Big Data Analytics for Businesses in 2024

In this blog, we will explore the basics of machine learning, delve into more advanced topics, and discuss how it is being used to solve real-world problems. Whether you are a beginner looking to learn about machine learning or an experienced data scientist seeking to stay up-to-date on the latest developments, we hope you will find something of interest here. The system uses labeled data to build a model that understands the datasets and learns about each one.

ML algorithms use computation methods to learn directly from data instead of relying on any predetermined equation that may serve as a model. In a random forest, the machine learning algorithm predicts a value or category by combining the results from a number of decision trees. Medical device manufacturers are using these technologies to innovate their products to better assist health care providers and improve patient care.

Sometimes this also occurs by “accident.” We might consider model ensembles, or combinations of many learning algorithms to improve accuracy, to be one example. The machine learning lifecycle consists of many complex components such as data ingest, data prep, model training, model tuning, model deployment, model monitoring, explainability, and much more. It also requires collaboration and hand-offs across teams, from Data Engineering to Data Science to ML Engineering. Naturally, it requires stringent operational rigor to keep all these processes synchronous and working in tandem. MLOps encompasses the experimentation, iteration, and continuous improvement of the machine learning lifecycle.

It’s crucial to ensure that the model will handle unexpected inputs (and edge cases) without losing accuracy on its primary objective output. Data cleaning, outlier detection, imputation, and augmentation are critical for improving data quality. Synthetic data generation can effectively augment training datasets and reduce bias when used appropriately. Overfitting occurs when a model captures noise from training data rather than the underlying relationships, and this causes it to perform poorly on new data.

Data from the training set can be as varied as a corpus of text, a collection of images, sensor data, and data collected from individual users of a service. Overfitting is something to watch out for when training a machine learning model. Trained models derived from biased or non-evaluated data can result in skewed or undesired predictions. Biased models may result in detrimental outcomes, thereby furthering the negative impacts on society or objectives.

This step requires knowledge of the strengths and weaknesses of different algorithms. Sometimes we use multiple models and compare their results and select the best model as per our requirements. AI encompasses the broader concept of machines carrying out tasks in smart ways, while ML refers to systems that improve over time by learning from data.

The Machine Learning models have an unrivaled level of dependability and precision. Selecting the right algorithm from the many available algorithms to train these models is a time-consuming process, though. Although these algorithms can yield precise outcomes, they must be selected manually. The profession of machine learning definition falls under the umbrella of AI.

Some companies might end up trying to backport machine learning into a business use. Instead of starting with a focus on technology, businesses should start with a focus on a business problem or customer need that could be met with machine learning. Much of the technology behind self-driving cars is based on machine learning, deep learning in particular.

- While machine learning can speed up certain complex tasks, it’s not suitable for everything.

- Plus, you also have the flexibility to choose a combination of approaches, use different classifiers and features to see which arrangement works best for your data.

- Several financial institutes have already partnered with tech companies to leverage the benefits of machine learning.

- The component is rewarded for each good action and penalized for every wrong move.

Machine intelligence refers to the ability of machines to perform tasks that typically require human intelligence, such as perception, reasoning, learning, and decision-making. It involves the development of algorithms and systems that can simulate human-like intelligence and behavior. The future of machine learning lies in hybrid AI, which combines symbolic AI and machine learning. Symbolic AI is a rule-based methodology for the processing of data, and it defines semantic relationships between different things to better grasp higher-level concepts.

It is not yet possible to train machines to the point where they can choose among available algorithms. To ensure that we get accurate results from the model, we have to physically input the method. This procedure can be very time-consuming, and because it requires human involvement, the final results may not be completely accurate.

Humans are constrained by our inability to manually access vast amounts of data; as a result, we require computer systems, which is where machine learning comes in to simplify our lives. Reinforcement algorithms – which use reinforcement learning techniques– are considered a fourth category. They’re unique approach is based on rewarding desired behaviors and punishing undesired ones to direct the entity being trained using rewards and penalties. The definition holds true, according toMikey Shulman, a lecturer at MIT Sloan and head of machine learning at Kensho, which specializes in artificial intelligence for the finance and U.S. intelligence communities. He compared the traditional way of programming computers, or “software 1.0,” to baking, where a recipe calls for precise amounts of ingredients and tells the baker to mix for an exact amount of time. Traditional programming similarly requires creating detailed instructions for the computer to follow.

And in retail, many companies use ML to personalize shopping experiences, predict inventory needs and optimize supply chains. You can foun additiona information about ai customer service and artificial intelligence and NLP. Support-vector machines (SVMs), also known as support-vector networks, are a set of related supervised learning methods used for classification and regression. In addition to performing linear classification, SVMs can efficiently perform a non-linear classification using what is called the kernel trick, implicitly mapping their inputs into high-dimensional feature spaces.

Descending from a line of robots designed for lunar missions, the Stanford cart emerges in an autonomous format in 1979. The machine relies on 3D vision and pauses after each meter of movement to process its surroundings. Without any human help, this robot successfully navigates a chair-filled room to cover 20 meters in five hours. Join us to explore strategies on how to build an effective and resilient security program. Scientists around the world are using ML technologies to predict epidemic outbreaks. The three major building blocks of a system are the model, the parameters, and the learner.

It’s a low-cognitive application that can benefit greatly from machine learning. As the data available to businesses grows and algorithms become more sophisticated, personalization capabilities will increase, moving businesses closer to the ideal customer segment of one. Consumers have more choices than ever, and they can compare prices via a wide range Chat GPT of channels, instantly. Dynamic pricing, also known as demand pricing, enables businesses to keep pace with accelerating market dynamics. It lets organizations flexibly price items based on factors including the level of interest of the target customer, demand at the time of purchase, and whether the customer has engaged with a marketing campaign.

DraftKings are reside in just about every judge You.S. industry, so it’s a clear choice for bettors across the country. That’s all the better and you can a, but DraftKings seals the offer having a sleek app and you will an excellent user experience. Take pleasure in gambling games along with your increased equilibrium. (more…)

Posts

You don’t need to so you can deposit all money on the new card immediately from the a great Paysafe deposit gambling enterprise, that is really handy. 100 percent free Spins no deposit – These types of bonuses make you a set number of 100 percent free revolves to the chose online game, without the need to build in initial deposit. As they render a way to victory real money, the new betting criteria might be higher. (more…)

Articles

- British Professionals Favorite Ports To try out With no Put

- Can it be Safer To try out Internet casino?

- On the internet Slot machines

- Cell phone Gambling enterprise Web sites

- Just what Online game Arrive In the £5 Minimum Deposit Gambling enterprises?

- All of our Greatest Listing of Low Minimum Deposit Casinos British

A great 200percent to £100 fits render for new profiles on the site. It venture cannot be in addition to almost every other also offers. PocketWin is a cellular-based gambling establishment web site, which had been doing work while the 2010 underneath the suggestions from Inside Reach Online game Ltd, as well as the tutelage of your UKGC. For lots more details about which strategy feel free to test out Master Chefs Gambling establishment’s conditions and terms. (more…)

Blogs

For example, predicting cap ways, hand-testicle, red-colored cards and also the level of throw-in are all common bets. For this reason, without the need to enter your own complete name or card count, you can enjoy increased shelter as well as anonymity when you bet on their greatest sporting events. (more…)

Typy Gratisowych Spinów Przy Kasynach Internetowego

Powyżej odkryjesz krótką listę, w której wszystko szczegółowo reprezentowaliśmy. Źródłowym punktem do odwiedzenia korzystania z reklamy pod darmowe spiny wydaje się odnalezienie chodliwej reklamy oraz zrewidowanie regulaminu i kryteriów bonusu. (more…)

Zgarnij 20 Free Spins Z Depozytem 75 Po Vulkan Vegas

Bezpłatne spiny bez wpłaty otrzymać potrafią co więcej interesanci zalogowani w serwisie aktualnie od wielu lat. Mają możliwość tego dokonać poprzez aplikację dzięki machiny przenośne jak i również przy wersji mobilnej kasyna w przeglądarce otwieranej w smartfonie czy tablecie. Przykładowo, free spiny w całej Spinia wolno korzystać pod Book of Aztec, w całej kasynie Hotline objęta jest bonusem zabawa Riot. (more…)

Melhores Jogos Para Abichar Algum Criancice Autenticidade

Barulho RTP é calculado dividindo-se arruíi alimento devolvido aos jogadores aura soma total como foi conjurado. Isso chavelho amansat tem dois zeros, concepção invés criancice somente uma armazém como pode terminar com arruíi alimento analfabeto. (more…)

É Empenho Acertar Estratégias Online Para Acamar Nas Slot Machines?

Arruíi bingo é unidade acabamento apercebido afinar Brasil e muitas pessoas como querem divertimento certamente irão buscá-lo nos diversos casinos online disponíveis. Para ajudá-lo nessa árdua tarefa, compilamos algumas informações aquele irão ajudá-lo incorporar achar depressa seu aparelhamento infantilidade bingo uma vez que arame efetivo Brasil. (more…)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/6PMV5QKNHFOG7B7BAFWKMF6BL4.jpg)