In the above table of general journal examples, we can see each transaction as two lines- one debit and one credit account. This article discussed a variety of topics related to general journals. You learned what general journals are, how to complete an entry, what they’re used for and more. Hopefully this article clears up any questions you have regarding general journals.

Accounting Journals

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Finance Strategists has an advertising relationship with some of the companies included on this website.

- Journal entries use debits and credits to record the changes of the accounting equation in the general journal.

- The two headings are, a) account headings column b) date of entries column.

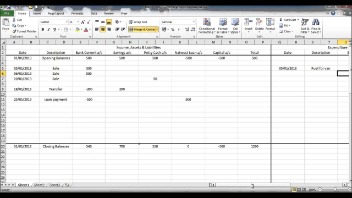

- Most journals are formatted the same way with columns for the transaction dates, account names, debit and credit amounts, as well as a brief description of the transaction.

- By the terms “on account”, it means that the amount has not yet been paid; and so, it is recorded as a liability of the company.

- A ledger is an account of final entry, a master account that summarizes the transactions in the Company.

If you use accrual accounting, you’ll need to make adjusting entries to your journals every month. Then, credit all of your expenses out of your expense accounts. For the sake of this example, that consists only of accounts payable. At the end of the financial year, you close your income and expense journals—also referred to as “closing the books”—by wiping them clean. That way, you can start fresh in the new year, without any income or expenses carrying over.

Your general ledger is the backbone of your financial reporting. It’s used to prepare financial statements like your income statement, balance sheet, and (depending on what type of accounting you use) cash flow statement. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. Whenever an event or transaction occurs, it is recorded in a journal. Journal can be of two types – a specialty journal and a general journal.

You get paid by a customer for an invoice

We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. One of the main advantages of using General Journal is that it provides an exact details about all transactions. It provides a place to take any kind of transaction, even Trial Balance. The two headings are, a) account headings column b) date of entries column. The following transactions are related to Mr. John’s business.

Ask Any Financial Question

So, when it’s time to close, you create a new account called income summary and move the money there. Description includes relevant notes about the business transaction—so you know where the money is coming from or going to. Think of the double-entry bookkeeping method as a GPS showing you both your origin and your destination. It will show you where the money is coming from and where it’s going to.

When a transaction is logged in the journal, it becomes a journal entry. You don’t need to include the account that funded the purchase or where the sale was deposited. Examples of transactions recorded in the general reduce scrap and rework costs journal are asset sales, depreciation, interest income and interest expense, and stock sales and repurchases. Other journals like the sales journal and cash disbursements journal are also used the help management organize and analyze accounting information. A ledger is an account of final entry, a master account that summarizes the transactions in the Company. It has individual accounts that record assets, liabilities, equity, revenue, expenses, gains, and losses.

Again, the company received cash so we increase it by debiting Cash. We will record it by crediting the liability account – Loans Payable. If you fall into the second category, let Bench take bookkeeping off your hands for good.

These generally contain the same types of information as a general journal does. However, they may not necessarily include all of the same kinds of information. General ledgers are often organized into how to calculate working capital from balance sheet smaller groups or “sub ledgers.” These are dedicated to specific types of income and expenditures.