Through careful adjustments and verifications, the reconciliation process aims to provide a clear understanding of a company’s financial position. This meticulous approach helps in identifying and rectifying any irregularities, supporting informed decision-making and financial transparency. When you create a new account in QuickBooks, you pick a day to start tracking transactions.

How to Reconcile Bank Statements in QuickBooks Online?

Marking transactions as cleared in QuickBooks Online signifies the validation of these transactions against the bank statement, contributing to the accuracy of the reconciliation process. This helps to verify the accuracy of the recorded transactions and identify any discrepancies between the company’s books and the actual bank statement. This phase is crucial as it ensures accuracy and integrity in financial reporting, aiding in identifying any discrepancies or errors that need to be resolved before finalizing the reconciliation process. When reconciling an account, the first bit of information you need is the opening balance.

This is an important procedure to ensure that the financial records reflect the actual state of the business’s transactions. It involves analyzing and adjusting any discrepancies in the previously reconciled transactions, thereby maintaining the integrity of the accounting system. Rereconciling in QuickBooks involves the process of reviewing and revalidating previous reconciliations to address any discrepancies or updates in the financial records, ensuring ongoing accuracy. This finalization stage is vital for ensuring the accuracy and integrity of the financial data, providing a clear overview of the company’s financial position and allowing for informed decision-making. This essential tool can be accessed by navigating to the ‘Accounting’ menu, followed by ‘Reconcile.’ Once in the reconcile module, users can select the appropriate account and statement date for reconciliation. The reconcile tool offers functionalities such as matching transactions, flagging discrepancies, and providing a clear overview of the financial alignment between the records and the bank statement.

If you’re reconciling an account for the first time, review the opening how to calculate accrued payroll balance. It needs to match the balance of your real-life bank account for the day you decided to start tracking transactions in QuickBooks. Reviewing transactions in QuickBooks Desktop is essential to identify any discrepancies and ensure that the recorded transactions correspond accurately with the bank statement. Reviewing transactions in QuickBooks Online is essential to identify any discrepancies and ensure that the recorded transactions correspond accurately with the bank statement. Just like balancing your checkbook, you need to review your accounts in QuickBooks to make sure they match your real-life bank and credit card statements.

Step 1: Make sure you have everything needed to reconcile in QuickBooks

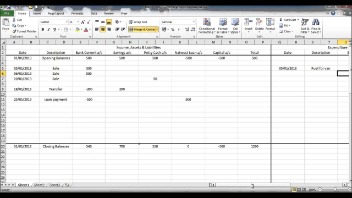

When you reconcile, you compare your bank statement to what’s in QuickBooks for a specific period of time. In the end, the difference between QuickBooks and your bank accounts should be US $0.00, although processing payments can sometimes cause a small gap. Comparing transactions in QuickBooks with the bank statement is essential to identify any disparities and ensure the accurate alignment of financial records with the official bank records.

Gather Bank Statement and Transactions

- This process is essential for maintaining accurate financial information and ensuring that the company’s records are in line with its actual financial position.

- Any discrepancies should be thoroughly investigated and adjusted in QuickBooks to reconcile the balances accurately.

- It involves analyzing and adjusting any discrepancies in the previously reconciled transactions, thereby maintaining the integrity of the accounting system.

Select the account you wish to reconcile from the Account drop-down menu. If you forgot to enter an opening balance in QuickBooks in the past, don’t worry. The journal entry goes into a special expense account called Reconciliation Discrepancies.

What is Reconciliation in QuickBooks?

Having up-to-date and accurate accounts is important for any business. You can also make small edits if needed right within this window. For example, if the payee is wrong, you can click on the transaction to expand the view and then select Edit. After you reconcile, you can select Display to view the Reconciliation report or Print to print it. QuickBooks Online and Wise Business can be connected and automatically synced. This is a time-saving feature that can benefit any business user.

Are you looking to master the art of reconciliation in QuickBooks? Whether you’re using QuickBooks Online or QuickBooks Desktop, understanding the process of reconciliation is crucial for ensuring the accuracy and integrity of your financial records. In this comprehensive do sales revenues affect the break-even point guide, we’ll walk you through the step-by-step process of reconciling your accounts, including bank statements and balance sheet accounts. This meticulous process aids in maintaining the integrity of financial data and enables businesses to track their financial health effectively.

Marking transactions as cleared in QuickBooks Desktop signifies the validation of these transactions against the bank statement, contributing to the accuracy of the reconciliation process. Regular reviews help in detecting potential errors or fraudulent activities, thereby safeguarding the financial integrity of the business. It also streamlines the reconciliation process, providing a clear and up-to-date financial overview for informed decision-making. By finalizing the reconciliation process, businesses can have understanding gaap vs ifrs confidence in the reliability of their financial records and make informed decisions based on accurate data.